AgriFood Tech Investment Continues to Climb Amid Pandemic

by Arama Kukutai (Cofounder and Partner) and Ingrid Fung (Investment Director)

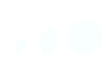

Despite the current political climate and economic uncertainty brought on by COVID-19, growth in the AgriFood Tech sector has been remarkably strong in 2020. At the onset of the pandemic, we saw investors rush to deploy capital into portfolio companies to extend runway beyond the COVID window. This year has already been a record-breaker for the AgriFood Tech sector -as of the end of Q3, AgriFood tech startups raised $11.6B in funding in 2020, bringing the investment total from 2010 through Q3 2020 up to $46.4B. Let’s unpack the data.

AgTech Investment

The pandemic has seen consumers and investors alike become acutely aware of supply chain and challenges in food production. On the farm, notwithstanding a pragmatic attitude among producers attention has also been focused on worker safety, and disruption to everyday work especially in crops where workers are in close proximity – automation is very much on the agenda, as are areas like Indoor farming. Meanwhile mainstays like crop protection continued to bring in new capital, and animal health also saw an uptick.

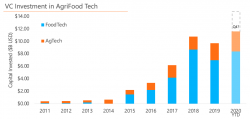

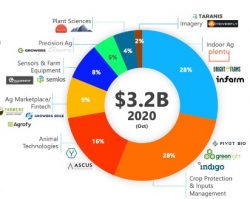

AgTech investment totaled $3.07B in the first three quarters of 2020, already overtaking 2019 total of $2.7B. While investment in Q3 2020 dropped to $825.8M, down from a quarter-high mark of $1.57B in Q2, the sector continues to show consistent growth year on year. Q3 2020 represents the second strongest quarter for AgTech investment since 2010, in comparison Q3 2019 saw only $758.5M in capital deployed.

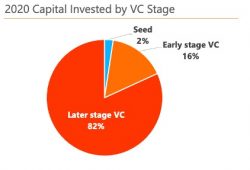

As the AgTech investment ecosystem continues to mature in 2020, we again see Later Stage VC deals capturing the majority of capital deployed into the sector. With 82% of capital deployed into AgTech going to Later Stage rounds, two sub segments, Indoor Ag and Crop Protection Inputs Management emerged as category leaders. Demand for fresh produce is driving new investment into indoor producers, with import and domestic field production unable to keep pace, and local sourcing, better quality and sustainability drivers all helped. 2020 has proven to be breakthrough year for Indoor Ag, with the segment capturing 28% of capital deployed into AgTech (up from 40% year on year from 2019) through mega rounds like those of Plenty ($315M), InFarm ($170M), and Bright Farms ($100M). Likewise, increasing awareness on the impacts of food production on climate change, land-use, and the incidence of pandemics, has increased investment into Crop Protection and Inputs Management companies. Investors and consumers alike have awoken to the intersection of life sciences and agriculture and are investing into Crop Protection companies like Enko Chem ($45M), GreenLight Bio ($102M), and Pivot Bio ($100M) focused on developing more sustainable crop input solutions.

FoodTech Investment

The last decade, has seen consumer demand for convenient access to tastier, healthier, more sustainably and ethically produced food drive a burst of investment into FoodTech as investors, corporates, and start-ups hustled to meet these new demands. In 2020, consumer preferences have continued to evolve creating the emergence of a new wave of food companies focused on alternative proteins with better functionality, convenience, novelty and sustainability. Covid also brought a return to dining at home, and sizing up of the basket as well as online purchasing as consumers tried to limit in-person store visits.

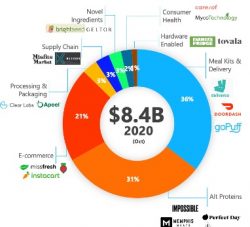

This trend of growth inFoodTech Investment has grown dramatically over the last 5 years, reaching a record high of $7B in 2019. Growth in FoodTech investment continues to grow strongly this year continuing the acceleration of capital to $8.4B as at Q3. A key continuing trend has been the rush of investments driven blitzscaling (the deployment of capital to take advantage of growth brought on by network effects) particularly in delivery and online commerce models. Investors are also doubling down on perceived the best-in-class companies, leading to more mega rounds (financings of $100M+) closed in in H1 2020 than ever before, including those of Rappi ($1B), DoorDash ($700M) and Impossible Foods ($300M).

While FoodTech has experienced a growth in capital deployment, Covid has had an uneven effect on subsets within the sector. Companies focused on the restaurant and foodservice markets have been confronted with lockdowns, and customer retreat. However, start-ups focused on Meal Kit solutions and E-commerce grocery are benefiting in revenue growth brought on the move to dining at home, and Ghost Kitchen sprung up to meet in-home delivery and new business models to utilize idled assets. Together, these leading segments within FoodTech captured over 57% of capital deployed in the first three quarters of 2020 reflecting strong investor interest. Supply chain optimization solutions, and platforms that simplify food procurement, preparation, and delivery are also seeing significant growth in a COVID-impacted world. Indeed companies from the Finistere Ventures portfolio such as Good Eggs, Farmer’s Fridge and Tovala have already experienced strong growth, and improving customer acquisition metrics this year.

The rise in concern around the impacts of meat production on environmental and human health has continued strong financings into Alternative Protein as pioneer companies like Beyond Meat are joined by a wave of plant-based competitors, and new approaches in cultivated and fermented products. Alternative Protein start-ups are companies that leverage processing, formulation, and biotechnology to produce products and ingredients that replace animal derived proteins. These companies have commanded 31% of capital deployed into FoodTech in 2020, reflecting the increase in investor interest in the sector that has been characterized by mega-rounds like those of Memphis Meats ($186.3M), Perfect Day ($300M) and LiveKindly ($335M). However, deep technical challenges for biotech enabled platforms combined with high capital intensity required to build production facilities and marketing/channel investments, mean that this segment will large amounts of patient capital to succeed. While the first wave of successful alt-protein companies was enabled by first mover advantage and brand engagement, the next wave will need to show superior product experience, differentiated offers and improving economics especially in fermented and cell-based products.

Exits and Conclusions

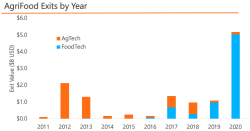

While as a whole AgriFood Investment has continued to show strong growth in 2020, there has been strong differences emerging between the B2B focused AgTech, and largely B2C Food tech startups. This is reflected in very different market dynamics especially in scale of revenue, in terms of exits, capital timeframes, and geographically different investor bases. In the early part of the decade, AgTech led the broader category investment both by capital invested, and by exit activity. However, from 2016 onward FoodTech Investment has grown dramatically, and has come to carve out the larger share of investment in terms of total capital invested and exit value as of 2020. The flow of capital is shifting within the AgriFood market towards later stage and larger deals as it continues to mature.

Notwithstanding the substantial progress made over the last decade, the sector is still accelerating, reflecting both increased appetite and awareness, and a recognition of the scale of the markets from farm to consumer. Additionally, these old-line industries from farming to food seem ripe for disruption. The number and diversity of investors entering the AgriFood space also reflect the growing importance of the Asset class as a whole. The first wave of public exits, and the strong interest from the markets for exposure to sustainability in particular are likely to see a much greater level of IPO and SPAC activity over the coming years, notwithstanding in AgTech the likely exit mode is still principally in M&A.