Finistere and PitchBook: Agrifood investment trends in the COVID-19 era

July 28, 2020

By Arama Kukutai, Ingrid Fung and Jennifer Place, Finistere Ventures

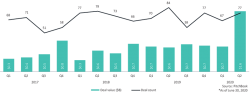

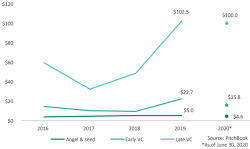

The results from Q2 are in, and they are remarkable. Agtech investment totaled $2.2 billion for the first two quarters of 2020; in contrast, our 2019 Report with PitchBook Data noted $2.7 billion was raised in 2019 FY and represented the highest year of funding on record. In foodtech, total investment for 2019 of $7 billion contrasted with Q1/Q2 2020 investment of $4.8 billion. Clearly, this has been an extraordinary period and investment result—and notably, in both agtech and foodtech, the bulk of capital came in Q2 as investors and companies reacted to the uncertainty of a global pandemic.

Global agtech VC deal activity

Global foodtech VC deal activity

Anecdotes from regular meetings with fellow venture capital firms (including Bayer Leaps, DCVC, Evolv, S2G, Lewis & Clark, Innovation Endeavors, Pontifax Agtech, TPG Circularis among others) indicate that syndicates with dry powder have moved quickly to extend the runway for their portfolio companies with bridge funding or round extensions intended to push drywell (or cash-positive) dates out to the end of 2021 and beyond. This is borne out by the review of deals showing that the majority of transactions was led by existing investors, notwithstanding many follower investors that also took the opportunity to add onto these rounds. In addition to helping startups push their funding needs outside the “COVID-19 zone”, it also enables companies to build more evidence of their value, particularly for planned Series B and later rounds where growth investors will be looking for signals of scalability.

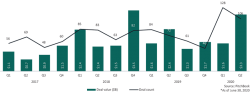

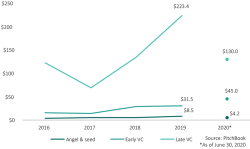

At Finistere, we also saw planned rounds in diligence accelerated as pragmatic startup leaders (and their current investors) pushed to close additional capital for the same reasons. It is unsurprising that new investor-led rounds have been a lesser part of the total, which is likely to continue while capital managers take stock of the market conditions–likewise, with some exceptions, we expect valuations will be under pressure looking forward. Valuations tend to be “sticky” so it will likely require a year or more for the true impact of COVID-19 to manifest in this metric. That said, we can see a clear delineation by stage impact. While pre-money valuations in early-stage investments across agrifood have decreased, valuations for late-stage financings have remained strong despite the current pandemic.

Global median pre-money valuations ($M) by stage in foodtech

Global median pre-money valuations ($M) by stage in agtech

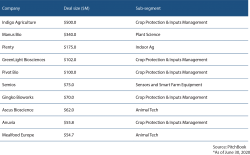

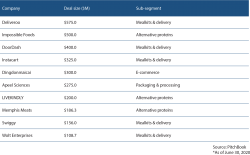

The table below shows the top 10 deals by funding size in agtech and foodtech companies in the year to date. Notwithstanding pragmatic support for existing portfolio companies, the underlying trend toward growth in capital for the sector continues for now, aided by a continued growth in new investors gravitating to foodtech in particular. It remains to be seen how persistent this trend is, particularly in agritech, where company development cycles are lengthy, and exit activity to date has been muted. Another trend that is notable is the continued incidence of mega-rounds (financings of $100 million or more in aggregate capital), which describes all top 10 foodtech deals and 50% of the top agtech deals.

Top 10 agtech VC financings in H1 2020

Top 10 foodtech VC financings in H1 2020

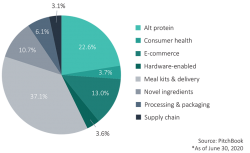

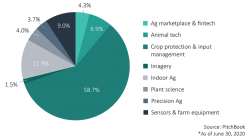

The major categories in agtech and foodtech are shown in percentage terms in the pie charts below. The major change in the agtech segment is the increased domination of the Crop Inputs and Input Management segment at 60% of all funding. The mega round of funding for Indigo, with Greenlight and Pivot, underpin this startling result. The new emerging category was Animal Tech, which captured approximately 7%, but is likely to be a growing category. The foodtech sector’s most notable, but unsurprising, development was the rise of Alternative Proteins to the second-place spot behind continued leader Mealkits and Delivery, displacing e-commerce, which dropped to the third-most invested sub-segment.

Share of global VC deal value (%) in foodtech by subsector for 2020

Share of global VC deal value (%) in agtech by subsector for 2020

Conclusion: What’s next?

Agtech companies are likely to face a turbulent outlook for 2021. With farming margins already under pressure prior to the pandemic, the availability, cost and health of labor, trade conflicts and consumer/voter pressure for sustainability gains all pose meaningful headwinds. The venture investment consequence is likely to be that startups in this space are under a double imperative: to prove their return on investment to farmers and their agronomists that they are essential and will help drive better on-farm profit, while also showing they can scale to profitability. We expect consolidation in the industry will continue to negatively impact investment and exits in the short term. That said, true breakthrough innovation is likely to be rewarded with companies like Enko Chem and ZeaKal in our portfolio working to create pipelines of safe chemical candidates and improved composition and yield in row crops. Major input players like Bayer, Corteva and Syngenta need new technologies to fill their product pipelines to have better prospects to show both farmers and public markets that there is more afoot than just cost savings as they work through the consolidation process.

In contrast, the foodtech sector, while challenged in foodservice, has some promising tailwinds. In particular there are startups benefiting from the move to dining at home, with both meal solutions and e-commerce grocery benefiting in revenue growth. The best-in-class companies from our portfolio such as Good Eggs, Farmer’s Fridge and recent addition Tovala are seeing strong metrics in this respect, and improving customer acquisition. It is our view that there will be lasting and persistent changes to consumer behavior in at-home consumption, and interesting to note this is the first year since 1994 that restaurant share of food consumption dropped versus in-home. Retaining these customers and growing margins will be key to future funding rounds, but the trend looks promising for this cohort. The boom in Alternative Protein financing over the last three years has been widely covered, but this segment also continued to draw in the cash with mega-rounds like those of Memphis Meats and Perfect Day underlining investor appetite for the cellular Ag/cultivated proteins sector. Given the deep technical challenges underpinning these platforms and the capital intensity required to build operating facilities as well as marketing and channel investment for go to market, this segment will likely need deep-pocketed support and patient money to succeed.

With the COVID-19-inspired influx of capital in Q2 likely to be continued in Q3 (though perhaps not at the same scale), the bigger question now posed is what the impact on rounds led by new investors and funding flows will be in the remainder of 2020 and first half of 2021. To some extent, the new normal is still being written. Will investors and startups alike be able to find ways to progress diligence and advance to investment? Will valuations shift to incentivize VCs and the large number of new entrants to continue to support the agrifood space with the high compounding growth rate we’ve seen in the last decade? What segments will prosper, or falter? At Finistere Ventures, we remain solidly positive about the growth prospects for the best teams and technologies in this sector, and notwithstanding stormy skies due to the pandemic, there is clearly an ongoing revolution occurring in agrifood.

Catch up with Finistere Ventures for additional industry insights.